The creator of South Korea’s leading search portal, Naver, has made a strategic shift from Nvidia GPUs to Intel CPUs due to widespread shortages and surging prices of AI-focused graphics processing units (GPUs) as reported by the Korean Economic Daily. This move highlights the escalating challenges faced by Nvidia in meeting the soaring demands of its diverse customer base.

Previously a staunch Nvidia customer, Naver Corporation had heavily relied on Nvidia GPUs to power its AI model, a critical component of the Naver Map software, which identifies and distinguishes false listings from authentic ones. The Nvidia GPUs played a pivotal role in executing crucial data processing, inference, and verification tasks within the software.

While Nvidia’s H100 (Hopper) GPU has been flying off the shelves worldwide, the company has been grappling with an unprecedented influx of orders, making it increasingly difficult to maintain an adequate inventory to sustain a steady supply chain.

Notably, the cost of Nvidia’s AI accelerators in South Korea has seen a staggering surge to 80 million won ($59,121), marking a 100% price escalation from the initial 40 million won ($29,561) recorded at the beginning of the year. Securing Nvidia’s AI GPUs has become a daunting challenge, even for financially well-endowed enterprises, with lead times now extended to a prolonged 52 weeks. Consequently, companies like Naver Corporation have initiated searches for alternative suppliers.

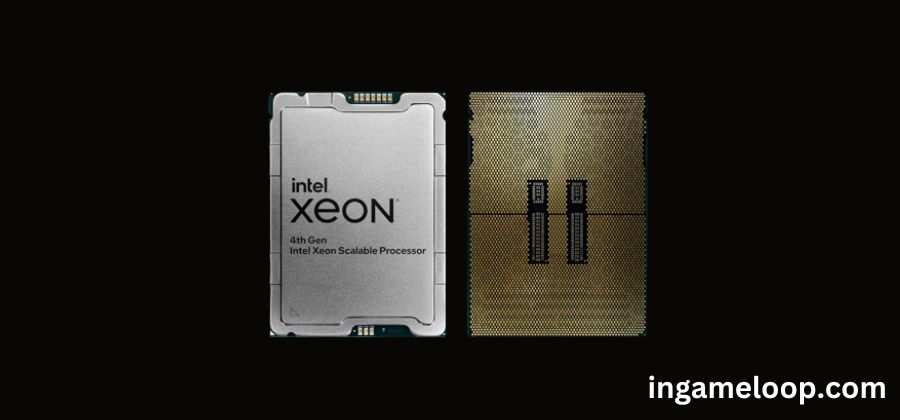

In response to this critical situation, Naver Corporation has opted to pivot towards Intel, shifting its focus from GPUs to CPUs. While GPUs typically outperform CPUs in AI inference workloads, providing speeds up to 10 times faster, Intel’s latest Xeon processors, particularly the 4th Generation Xeon Sapphire Rapids chips, have emerged as a credible substitute for Nvidia GPUs.

Following an arduous month of rigorous testing, Naver Corporation has made the strategic decision to incorporate Intel’s 4th Generation Xeon Sapphire Rapids chips into its AI servers. Amid these developments, Nvidia finds itself compelled to undertake a significant reallocation of resources, diverting up to $5 billion worth of AI and HPC GPUs.

Initially earmarked for Chinese clients including industry giants like Alibaba, Baidu, and Byte Dance, these GPUs are now being redirected in light of new export restrictions. Regrettably, this reallocation did not occur sooner, a factor that could have potentially played a crucial role in retaining Naver Corporation as a valued customer.

The exact magnitude of Naver Corporation’s significance as a client within Nvidia’s portfolio remains undisclosed. Nonetheless, industry analysts are speculating that this strategic shift towards Intel could potentially exert a negative impact on Nvidia’s market share within the global AI sector. Presently, Nvidia commands a dominant position, holding an estimated 80% share of the AI market.

Notably, Intel is not the sole contender making strategic moves in this competitive landscape. Persistent rumors since May suggest that Microsoft may also be poised to join forces with AMD, aiming to challenge Nvidia’s established position in the AI market.

As the pricing of AI-focused GPUs continues to escalate, businesses across various industries are likely to intensify their efforts in seeking cost-effective alternatives to meet their computational needs. This development underscores the ever-evolving dynamics of the semiconductor industry, where companies are compelled to adapt swiftly to emerging challenges and seize new opportunities.

Related:

Intel to launch 13th Gen Core non-K CPUs and B760 motherboards on January 3rd, 2023

Russian CPU Tested Against Intel and Huawei Processors Fails to Impress